Coinbase chief legal officer Paul Grewal discusses the ’emergence of the crypto voter’ on ‘The Claman Countdown.’

The U.S. cryptocurrency industry has overtaken some traditional big spenders in the 2024 election cycle in a bid to make Washington more favorable toward digital assets.

According to an analysis of Federal Election Commission filings by blockchain analytics platform Breadcrumbs and FOX Business, the digital asset industry has raised at least $238 million so far this election cycle from corporate contributions to super PACs and individual donations to candidates from top industry leaders. That’s more than the oil and gas industry, the pharmaceutical industry and top Wall Street donor hedge fund and market-making powerhouse Citadel, data compiled by OpenSecrets shows.

The industry’s largest corporate spenders — exchange Coinbase, blockchain payments company Ripple and venture capitalist firm Andreessen Horowitz — have donated a combined $160 million to a handful of pro-crypto super PACs supporting industry-friendly candidates in Congressional races.

GEMINI LAUNCHES GLOBAL AD CAMPAIGN AS CRYPTO BECOMES ELECTION TALKING POINT

Brian Armstrong, co-founder and chief executive officer of Coinbase Inc., speaks during the Singapore Fintech Festival, in Singapore, on Nov. 4, 2022. (Bryan van der Beek/Bloomberg via Getty Images)

“The crypto industry is sending a clear message to American politicians and elected officials with these donations: Current cryptocurrency regulations and policies are not working in the U.S.,” said James Delmore, a research analyst at Breadcrumbs.

Indeed, of the $238 million raised by the digital asset business and executives, roughly $181 million comes from crypto firms’ donations to super PACs. Another $57 million to individual candidates and committees supporting them came in from industry players like Ripple co-founder Chris Larsen, Andreesen Horowitz founding partners Marc Andreessen and Ben Howrowitz, and Gemini crypto exchange founders Tyler and Cameron Winklevoss. The analysis conducted by Breadcrumbs and FOX Business also counted Cantor Fitzgerald CEO Howard Lutnick as a crypto industry contributor due to his large investments in bitcoin and his advocacy for the sector.

COINBASE INVESTS $25M IN 2026 MIDTERM ELECTIONS WITH COMMITMENT TO PRO-CRYPTO SUPER PAC

While many donations from industry leaders have gone to pro-crypto congressional candidates, more than 50% have benefited presidential candidates Donald Trump and Kamala Harris, who have both made cryptocurrency campaign issues in the hope of plucking more votes from an increasingly active voter bloc.

A review of FEC data shows that Trump and Harris have racked up a combined $34 million in donations from crypto industry leaders to their campaigns as well as a handful of super PACS and fundraising committees supporting them. Trump has raked in over $22 million from at least 17 big donors, compared to Harris’s $12 million, 99% of which came from one person — Chris Larsen, Ripple co-founder and a Democrat. Larsen has given a total of $11.7 million to the vice president since August, the majority in Ripple’s native crypto token XRP.

A review of FEC data shows that Trump and Harris have racked up a combined $34 million in donations from crypto industry leaders. (Getty Images/FOX Business / Fox News)

Silicon Valley stalwart Reid Hoffman, the co-founder of LinkedIn who is now at venture capitalist firm Greylock Partners, donated $250,000 to the leading super PAC supporting Harris called Future Forward in October. Hoffman made his fortune in tech, but he is also an early investor in Coinbase, has owned bitcoin and invested in other crypto startups. Ron Conway, another tech investor and crypto advocate, donated at least $600,000 to Future Forward.

Trump, meanwhile, has a much longer list of individual industry donors that brings his total to $22 million ($8.3 million of that donated in cryptocurrency like bitcoin, ether and XRP), a reflection of the industry’s animus toward the Biden administration (which includes Harris) and its regulatory crackdown under Securities and Exchange Commission Chairman Gary Gensler, whom Trump vowed to fire “day one” if elected president.

Trump’s largest industry donor is Cantor’s Lutnick, a veteran Wall Street CEO, but a recent convert to crypto. He’s a bitcoin investor and overseer of a large portion of stablecoin company Tether’s $100 billion worth of U.S. Treasury holdings. He gave a speech at the annual Bitcoin Conference in July where he announced plans for Cantor to launch a bitcoin financing business, which will help provide leverage to investors who own the world’s largest digital currency. Lutnick is also the co-chair of Trump’s presidential transition team and has donated at least $6 million to the former president.

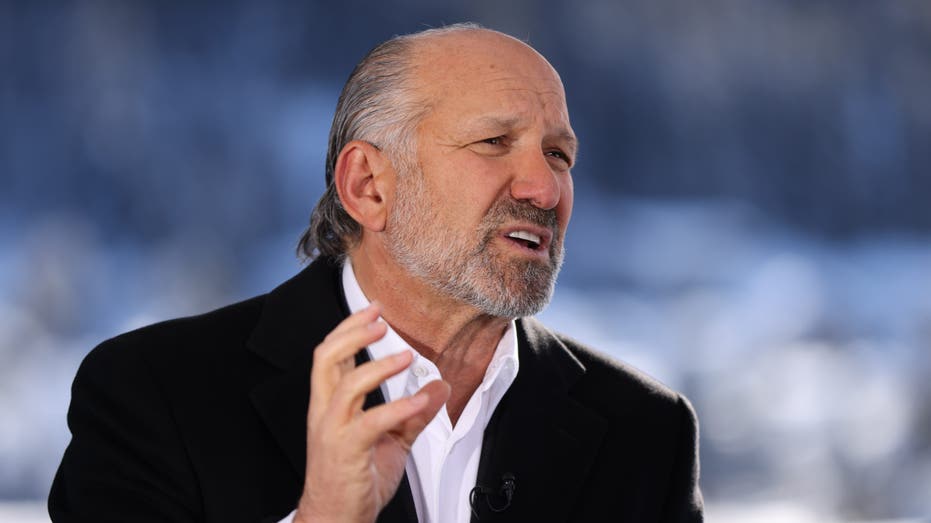

Cantor Fitzgerald CEO Howard Lutnick during an interview at the World Economic Forum in Davos, Switzerland, on Jan. 16, 2024. (Hollie Adams/Bloomberg via Getty Images / Getty Images)

Trump’s biggest crypto donors after Lutnick are Andreessen, who’s donated at least $5 million; Horowitz, who’s given $2.5 million, the Winklevoss twins, who have donated a combined $2.6 million; and Jesse Powell, founder of U.S. crypto exchange Kraken, who donated just over $1 million in June.

Other large donors include Bijan Tehrani, the CEO of crypto-backed online casino Stake, who donated $852,396 in ether; JP Richardson, the CEO of crypto wallet provider Exodus, who donated $853,914 in bitcoin; and Gary Cardone, an entrepreneur and bitcoin investor, who donated $844,474 in bitcoin.

BITCOIN MINERS LAUNCH AD CAMPAIGN IN SWING STATES TO BOOST CRYPTO-FRIENDLY CANDIDATES

Bitcoin Magazine CEO David Bailey, who secured Trump as a keynote speaker at the Bitcoin Conference, gave just under $500,000 in bitcoin to the former president, while Ripple’s general counsel, Stuart Alderoty, gave $300,000 in XRP.

The industry has been funneling most of its funds through pro-crypto super PACs like Fairshake and its affiliates, which have been spending large sums on ad campaigns for key congressional races with the hopes of packing both the House and the Senate with industry-favorable candidates who can help further policy. A spokesperson for Fairshake told FOX Business that it, along with affiliate PACs Defend American Jobs and Protect Progress, has raised $170 million of industry money, and spent $135 million of it this election cycle.

Cryptocurrencies are seen in this photo taken in Krakow, Poland on November 14, 2022. (Jakub Porzycki/NurPhoto via Getty Images / Getty Images)

The outsized spending has drawn fierce criticism from onlookers who see the massive contributions as an industry-wide effort to buy preferred policy outcomes.

“The millions crypto corporations and executives are spending is a brazen attempt by a relatively small sector to distort U.S. democracy to serve its profit-maximizing whims,” said Rick Claypool, research director at consumer advocacy organization Public Citizen. “By spending so much, the crypto sector has made its demands for light touch regulation and minimal enforcement impossible to ignore.”

Nonetheless, the super PACs’ efforts have had some success already in shutting out politicians they see as being anti-crypto. In March, Fairshake spent more than $13 million on attack ads against anti-crypto Democratic candidates — California Rep. Katie Porter, New York Rep. Jamaal Bowman and Missouri Rep. Cori Bush. All three lost their primary races.

Senate candidate, Rep. Katie Porter, D-Calif., speaks to members of the media during a campaign event on Feb. 24, 2024, in Emeryville, California. | Getty Images

As previously reported by FOX Business, Fairshake’s affiliate Defend American Jobs, which gives primarily to Republicans, spent $40 million on ad campaigns supporting Ohio Senate candidate Bernie Moreno, a businessman and crypto advocate, in his tightly contested race against incumbent Sen. Sherrod Brown.

Breadcrumbs and FOX Business analysis shows crypto super PACs’ total spending has now exceeded $137 million.

Breadcrumbs’ James Delmore contributed data to this report